The money Apple Card users get as a cash-back reward can go automatically into a savings account from Goldman Sachs, the same bank that backs the credit card.

The money saved will earn interest over time.

The money Apple Card users get as a cash-back reward can go automatically into a savings account from Goldman Sachs, the same bank that backs the credit card.

The money saved will earn interest over time.

Apple Card earned top marks in the annual J.D. Power U.S. Credit Card Satisfaction Study. Apple/Goldman Sachs beat out their rivals in the Midsize Credit Card Issuer segment, with users liking the benefits, rewards and more.

2022 is the second year in a row Apple Card took home this honor.

Anyone who uses an Apple Card can get Apple TV+ free for three months. And the deal isn’t limited to new subscribers – current ones also qualify.

It’s a promo for the new Apple TV+ movie Luck, and has the tagline, “It’s your lucky day. For three whole months.”

Use an Apple Card at certain online retailers and service providers between now and the end of July to earn 4% cash back. It’s a summertime promotion, and the companies involved offer sunglasses, movie tickets, coolers, hotel rooms, etc.

Apple Pay and the Mac-maker’s credit card regularly offer at least 2% cash back for online purchases but some special deals bring larger percentages. Like this one.

Rather than letting existing financial companies handle all its payment processing, Apple wants to bring some of it in-house, according to an unconfirmed report. And the Mac-maker would also like to take on a range of other related services itself.

The goal is to reduce the amount of money Apple has to pay outside companies for financial services.

Apple this week acquired Credit Kudos, a credit checking startup based in the United Kingdom, according to sources familiar with the matter. An update to the Credit Kudos website confirms it is now an Apple subsidiary.

The move has ignited rumors of an upcoming Apple Card expansion into the U.K. Apple fans on the other side of the pond have been eagerly anticipating its arrival since Apple Card first made its debut in the U.S. in 2019.

The iPhone Upgrade Program enables people to get a new Apple handset every year and pay it off in monthly installments, interest free. The monthly payments come from a credit card or a bank account. It’s possible to change which one at any time.

Many people who used the Upgrade Program to get an iPhone 13 want to do this because a bug prevented an Apple Card from being used for this on the handset’s launch day.

Here’s how to switch to a new credit card or bank account for Apple’s installment plan.

Shop at the Apple Store with an Apple Card and you’ll reportedly get double the usual cash back. There has been no announcement, but unconfirmed reports indicate that the usual 3% Daily Cash back jumped to 6%.

This same deal was offered back in 2019.

Apple Card users who ran into issues while trying to preorder iPhone 13 last month will receive a credit for the 3% Daily Cash they missed out on. Apple said in an email to customers that it apologizes for the inconvenience caused.

To continue receiving Daily Cash on future iPhone payments, Apple Card users can change their monthly payment method through Citizens One.

Cupertino profits from every Apple Pay transaction. And the money comes from big banks that issue the credit cards that get entered into the iPhone’s virtual wallet. Now, the banks are reportedly pushing to have the fees lowered.

And the fact that Apple created its own credit card to complete with the banks only made things worse.

![Why you’re having trouble making an Apple Card payment [Updated] Apple Card in POS](https://www.cultofmac.com/wp-content/uploads/2019/08/2653F0C8-F0D4-4C54-8423-3A5099CEB169.jpeg)

Apple Card users could be running into problems paying their bill on Friday because the online portion of the service is having a problem. This might also affect other aspects of using the card, but that does not include using the card to pay for purchases.

Update: Apple reported the problem fixed on Friday evening about 7.5 hours after it first cropped up.

The preorder experience for iPhone 13 proved less than enjoyable for many customers Friday morning, with Apple Store problems causing all kinds of headaches. Complaints quickly flooded Twitter as various errors plagued would-be upgraders fighting to get their orders in quickly.

Preordering iPhone 13 or iPhone 13 Pro tomorrow? Apple now gives you new ways to shop for its newest devices. Take advantage of additional pickup, payment, and delivery options, as well as carrier offers at Apple Retail stores.

The same options are also available for the new iPad and iPad mini, which are already up for preorder ahead of their debut on September 24.

Apple Card ranked highest in the Midsize Credit Card segment of the J.D. Power 2021 U.S. Credit Card Satisfaction Study. The credit card — which is issued by Goldman Sachs — also ranked highest in its segment across all of the surveyed categories, including credit card terms, benefits and services, and rewards.

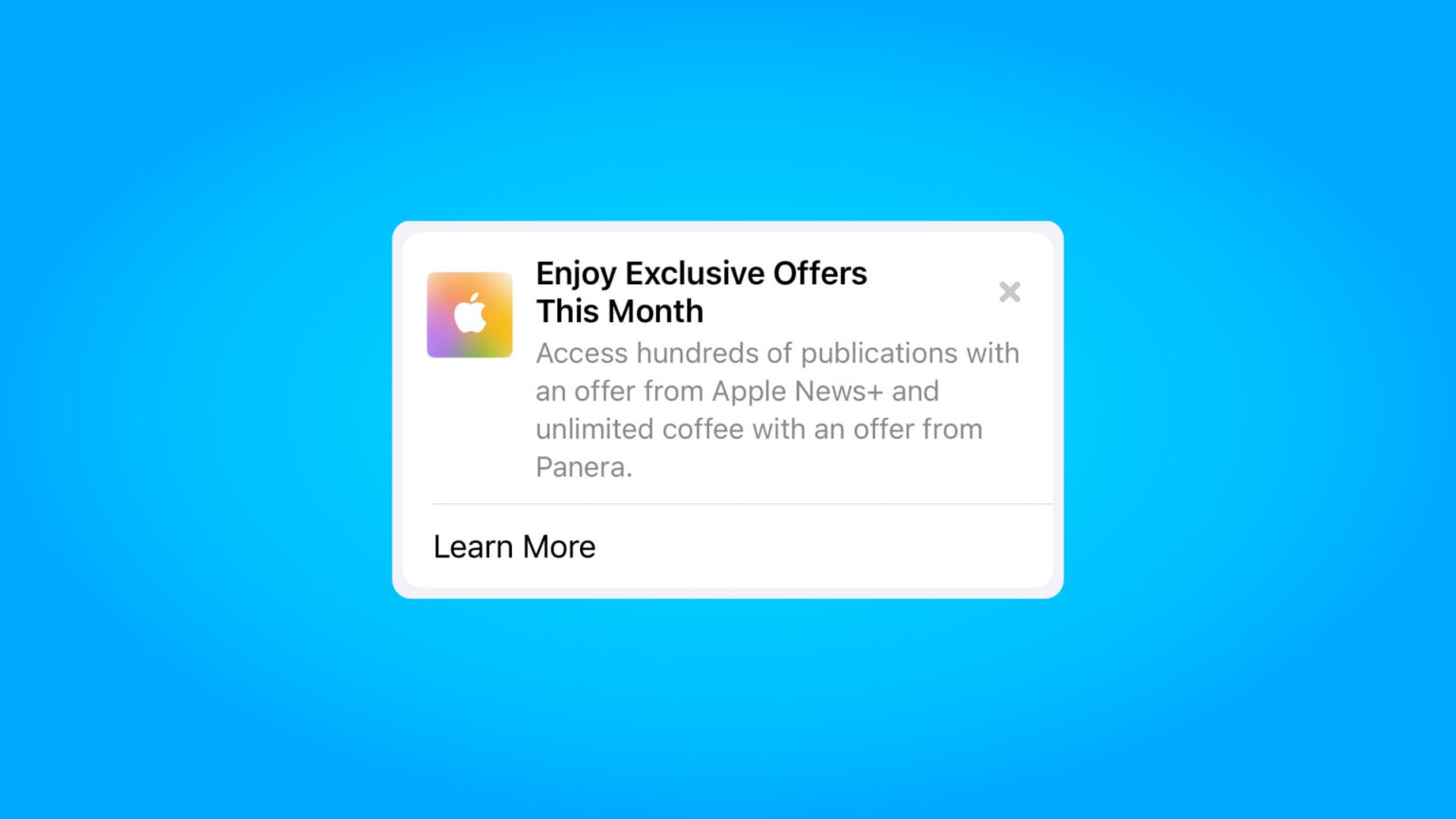

Apple Card users can now enjoy exclusive offers on Apple services and more. This month’s promotion gives you four months of Apple News+ absolutely free, as well as “unlimited coffee with an offer from Panera.”

Both macOS Big Sur 11.5 and iPadOS 14.7 made the jump from beta to full release on Wednesday. They bring only a handful of new features, though, as well as bug fixes.

The updates follow several days after the debut of iOS 14.7 for iPhone.

iPhone users can now download iOS 14.7. The update, released Monday, adds reverse wireless charging to the iPhone 12 series, albeit in a limited way. It also includes some promised improvements to the Apple Card, and allows users to manage timers on a HomePod.

In addition, Apple released watchOS 7.6.

Apple and its Apple Card partner, Goldman Sachs, plan to launch a new pay-in-installments service for all Apple Pay purchases reportedly known internally as “Apple Pay Later.” It resembles other “buy now, pay later” offerings from companies like Affirm Holdings and PayPal.

The release candidate for iOS 14.7 was seeded to developers on Tuesday. It includes some promised improvements to the Apple Card, and it enables users to use a just-announced MagSafe Battery Pack. In addition, it allows users to manage timers on a HomePod.

Plus, the macOS Big Sur 11.5 release candidate, iPadOS 14.7 RC, watchOS 7.6 RC and tvOS 14.7 RC were also made available for developers.

Apple has successfully fixed a problem that was stopping some Apple Card users from using Apple Pay with the Apple-branded credit cards in stores. On its System Status page, Apple noted that “Some users were affected,” although it does not provide details of the problem — or the fix that the company employed.

The issue was marked as revolved at 6.41 am ET/3.41 am PT on Wednesday, June 16. This was two days after Apple first noted it had a problem. No other problems were highlighted on the Systems Status page, which showed green lights across the board.

If you’re heading to the store with an Apple Card on Monday, you’d better bring a second form of payment. An ongoing technical glitch means that it might not be possible to make in-store purchases with the credit card.

![Here’s why you can’t make an Apple Card payment [Updated] Apple online services having technical problems](https://www.cultofmac.com/wp-content/uploads/2021/06/0D77D148-FD1F-4747-B71D-694D9AA1BF5D-1536x864.jpeg)

Update: Apple changed the status for Apple Card from “outage” to “resolved outage” Wednesday afternoon. The service was offline for almost exactly six hours.

Apple Card users may find that they’re unable to make a payment or see recent transactions. Apple reports that the software that handles these tasks for its credit card has been having problems for several hours.

Apple Card now gives users the ability to add a co-owner from their Family Sharing group. Co-owners share the same credit line and have the ability to add the card to Apple Pay, view their own spending activity, and more.

It’s also possible to share Apple Card with other members of your family (aged 13 years or older) and give them their own spending limit. Here’s how to start sharing yours on iPhone and iPad.

Since its debut in 2019, the number of Apple Card users has grown to 6.4 million, according to analysts. That’s over two times the total using the credit card a year ago. And much of the growth has been among women.

Apple Card holding parents can soon give their teenagers access to the credit card. Adults can share a card and teens can be allowed limited usage thanks to the upcoming Apple Card Family feature.